Cash Coach Consulting

Strategic personal and Business Tax Planning You Can Count On.

INVEST YOUR TIME AND EFFORTS ON BUILDING YOUR BUSINESS. LEAVE THE STRATEGY TO ME.

Trusted

Experienced

Professional

Comprehensive Business and Wealth Consultation

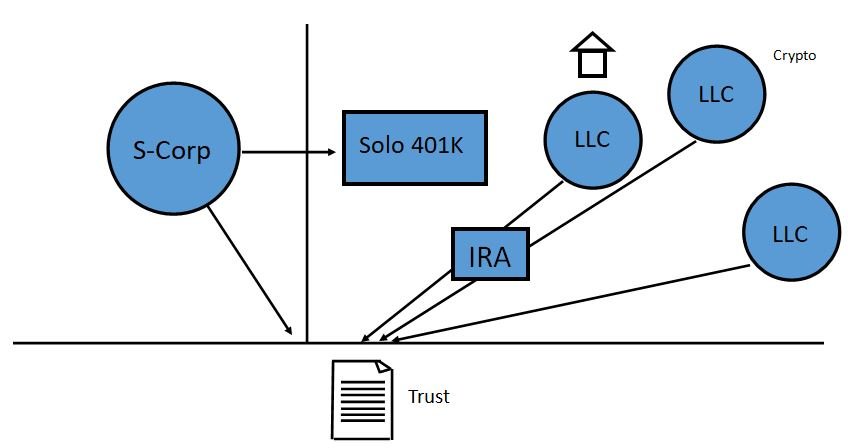

Schedule a consult and bring it all together in one picture. Part of our consult will be designing your trifecta. Which is a strategic diagram that organizes the three major areas of your tax and business world.

Business and Wealth Coaching

Meet with a Certified Tax Advisor to discuss relevant tax and business strategies. This is the perfect follow up for our Comprehensive Personal and Business Tax Consultation.

LLC Creation

Let me setup your LLC in any state to limit your liability. Includes EIN, S-Election, Articles of Organization, Meeting Minutes and a thirty minute consult to answer questions.

S-Election

Potentially save money on your taxes with this business structure. Seek a consultation to make sure this option is right for you. We will file your S-Election application along with Rev Proc attachment where necessary. Certified Tax Advisor consult time billed hourly (not included.)

Beneficial Ownership Interest Reporting

Effective January 1st, 2024, business owners and officers that exercise significant control or own 25% or more are required to report to FINCEN. Business formed after January 1, 2024 have 90 days to file. Business formed before January 1, 2024 have until December 31, 2024.

Certified Tax Advisor Consult

Speak with a Certified Tax Advisor about your Personal or Business related tax or organization strategies.

Tax Preparation, Bookkeeping and Payroll Services

While we do not offer these services in house I work closely with a large network of full service accounting firms that I can oversee and assist in managing.